According to a new study by the Taipei-based research institute Market Intelligence & Consulting Institute (MIC), 71.2% of internet users in Taiwan used delivery services in 2024, maintaining a steady growth rate compared to 2023. Meanwhile, the percentage of delivery service subscribers saw a modest increase of 1.3%, reaching 39.8%. Meanwhile, male subscribers outnumbered female subscribers by about 10%, and the 46-55 age group had the highest subscription rate at 44.1%, with 18-25-year-olds showing the biggest growth in new subscribers (7.7%).

Stable Growth with Increased Service Differentiation

MIC's senior Industry Analyst, Robin Hu, shared insights into Taiwan's delivery market, stating that it has entered a phase of stable growth, with service differentiation and value-added offerings becoming more similar across providers. While subscription memberships continue to show steady, albeit slight growth, explosive growth similar to that during the pandemic seems unlikely. In light of the growing cost of acquiring new customers, businesses are now focusing more on member management and increasing customer spending to counteract user churn, reduced usage frequency, and inflationary pressures on actual consumption.

Foodpanda and Uber Eats Narrow the Gap

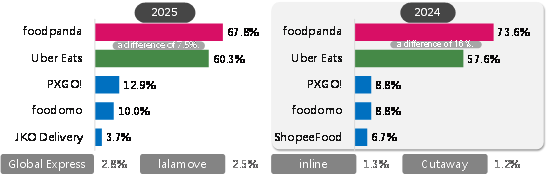

The survey revealed that the two leading platforms in Taiwan, Foodpanda and Uber Eats, maintained their top rankings, with the gap between them shrinking from 16% in 2023 to just 7.5% in 2024. Foodpanda experienced a 5.8% decline, while Uber Eats saw a modest 2.7% increase. Approximately 40% of users are now using both platforms, while 27.5% use only Foodpanda and 20% use only Uber Eats. Compared to 2023, the number of users exclusively using Foodpanda decreased by 2.6%, while those using only Uber Eats grew by 5.9%, suggesting a shift in user preference as platforms mature and struggle to differentiate themselves.

Which Delivery Platforms Have Users Used Most Frequently in the Past Year? (Multiple Selections Allowed, Up to 5 Options)

Note 1: Valid sample size: 759 for 2024, 761 for 2025

Note 2: ShopeeFood ceased operations in Q3 2022. Other commonly used delivery platforms include: McDonald's McDelivery (0.3%), Carrefour (0.1%)

Source: MIC, February 2025

Higher Spending Among Subscription Members

The survey also found that 53.9% of delivery users now spend more than NT$300 (USD 9.27; USD1=NT$32.4) per order, an increase of 1.7% from 2023. While average spending per order has risen slightly, this is largely attributed to inflation and rising delivery fees. Among subscription members, 64.4% spent over NT$300 per order, and 17.2% spent over NT$600 (USD18.54), far outpacing non-members. Subscribed users also showed greater interest in purchasing a variety of items, including fresh groceries, household goods, and frozen foods, with their purchases surpassing non-members by up to 20%.

Cost of Delivery and Service Quality Remain Key Factors

The survey also found that 68% of users were influenced by high delivery fees, with 32% opting to pick up their orders in person instead of using delivery services. Poor platform service quality led 28% of users to stop using a delivery service, while 23% felt they no longer needed delivery at all. Across age groups, users aged 36-45 were most concerned with delivery fees, while those aged 26-55 preferred to pick up orders themselves. Interestingly, the 56-65 age group was most concerned with service quality.

The Role of Brand and Differentiation in the Competitive Landscape

Hu emphasized that as delivery platforms transition to stable growth, brand management is becoming more crucial. With less clear service differentiation, the process of platform switching has become easier for consumers, making brand impression a critical factor in users' decision to continue using a particular platform.

Survey Details: Conducted between mid-November and early December 2024, the online survey gathered 1,068 valid responses with a margin of error of ±3.0% at a 95% confidence level.

This growing trend toward both service differentiation and consumer brand loyalty underscores a key transition period for Taiwan's delivery platforms, as businesses refine their customer engagement strategies.

About Market Intelligence & Consulting Institute (MIC):

Established in 1987, the Market Intelligence & Consulting Institute (MIC) is a division of III (Institute for Information Industry), a leading government think tank and one of Taiwan's foremost IT research institutes. With over three decades of experience, MIC specializes in industry and market research, delivering data-driven insights and strategic recommendations to assist businesses in making informed decisions.

For future receipt of press releases, please subscribe here

To know more about MIC's research findings, please access our website at https://mic.iii.org.tw/english/

For inquiries, please contact MIC Public Relations, Catherine Hung, at hungcat@iii.org.tw

If you prefer not to receive notifications, please click here to unsubscribe