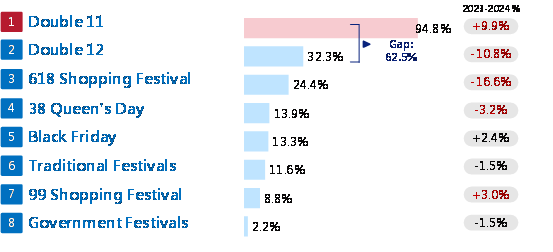

The Market Intelligence & Consulting Institute (MIC) has released its 2024 E-Commerce Shopping Festival Consumer Survey, revealing that the top five most popular shopping festivals among Taiwanese consumers are Double 11 (95%), Double 12 (32%), 618 Festival (24%), Queen’s Day (14%), and Black Friday (13%). The top three rankings have remained unchanged since 2022. However, participation rates show shifts, with Double 11 growing by 10% year-over-year, while Double 12 and 618 experienced declines of 11% and 17%, respectively. In addition, the participation gap between Double 11 and Double 12 widened from 40% in 2023 to 60% in 2024.

Over the past year, which "e-commerce shopping festivals" have you most frequently participated in? (Multiple choices, up to 3 selections allowed)

Note 1: The 2024 survey had 640 valid samples, and the 2023 survey had 596 valid samples.

Note 2: Numbers in red indicate a change of more than 3% (increase or decrease) in participation rates from 2023 to 2024.

Note 3: Traditional festivals include Father's Day, Chinese Valentine's Day, and Ghost Festivals

Note 4: Government festivals include Mid-Autumn Festival.

Source: MIC, December 2024

MIC industry analyst Julia Tu noted a growing trend of concentration in e-commerce festival participation. Over 80% of respondents participated in three or fewer shopping festivals annually, with the majority focusing on just two festivals in 2024. This marks a shift from 2022, when three festivals were the most common. The trend reflects consumer fatigue with the proliferation of shopping festivals, coupled with a stronger awareness that discounts during Double 11 are significantly more attractive than other events, further driving focus on this single festival.

The survey also identified the top five most frequently used platforms during shopping festivals. Comprehensive e-commerce platforms (83%) took the lead, followed by online channels of physical retailers (31%), third-party delivery platforms (16%), brand-owned e-commerce sites (15%), and livestream shopping platforms (14%). Livestream shopping platforms have risen to prominence, displacing social media or messaging apps as the fifth most popular choice.

Age-based preferences revealed generational differences in platform usage. For consumers aged 18-25, third-party delivery platforms ranked second in popularity, while those aged 26-65 preferred online channels of physical retailers. Additionally, brand-owned e-commerce sites were most favored by consumers aged 18-35, while livestream platforms found the greatest appeal among those aged 26-35.

This analysis underscores evolving consumer behaviors, with a growing preference for streamlined shopping experiences and a focus on high-value events like Double 11.

About Market Intelligence & Consulting Institute (MIC):

Established in 1987, Market Intelligence & Consulting Institute (MIC) is a division of III (Institute for Information Industry), a major government think tank, and one of the leading IT research institutes in Taiwan. MIC specializes in industry and market research. With over three decades of experience, MIC provides valuable insights and data-driven recommendations to assist businesses in making informed decisions.

For future receipt of press releases, please subscribe here

To know more about MIC's research findings, please access our website at https://mic.iii.org.tw/english/

For inquiries, please contact MIC Public Relations, Catherine Hung, at hungcat@iii.org.tw

If you prefer not to receive notifications, please click here to unsubscribe