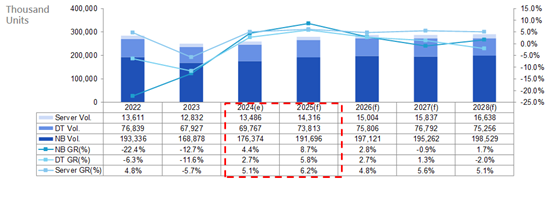

Market Intelligence & Consulting Institute (MIC) hosts the 37th MIC FORUM Spring from April 16th to 18th, unveiling its latest predictions for the information and communication technology (ICT) industry. In 2024, amid the global economic recovery, the ICT industry is cautiously optimistic, with the AI trend fueling growth in global IT hardware shipments. Particularly, after two consecutive years of decline, PC shipments are expected to see positive growth in 2024, driven by an anticipated global replacement demand cycle. Global notebook and desktop PC shipments are forecasted to reach 176 million units and 69.77 million units this year, growing by 4.4% and 2.7%, respectively. With its software and hardware integration becoming more comprehensive by 2025, AI PC is poised to become a key driver of the IT hardware recovery.

Taiwan IT Hardware Market Volume, 2022-2028

Note 1: GR = Year-on-Year Growth Rate

Note 2:Desktop PC volume includes AIO PCs

Source: MIC, April 2024

Global server shipments are projected to reach 13.49 million units in 2024, growing by 5.1%. AI servers are expected to experience continuous demand growth, driven by factors such as generative AI large language models (LLMs) and enterprise internal model fine-tuning, making AI servers a major driving force in the server market. AI server is anticipated to account for approximately 16.2% of the total server share in 2024. increasing to 21.5% by 2027.

Taiwan's notebook PC and server shipments are synchronously rebounding with the global market. It is estimated that Taiwan's notebook and desktop PC shipments will reach 135 million units and 38.09 million units in 2024, growing by 2.2% and 2.6%, respectively. Benefiting from orders for AI servers from cloud service providers and brands, Taiwan's server shipments are forecasted to reach 11.11 million units this year, growing by 4.3% year-on-year. With regional economic recovery, replacement demand following the termination of Windows 10, and clearer specifications for AI PCs, notebook PC shipments are expected to be concentrated in the second half of the year, with a more pronounced peak season effect compared to 2023. As for desktop PCs, with new products launching in the second quarter, demand is expected to be stronger than in the first quarter. Additionally, as inflation pressures in the United States ease, commercial demand for extended use of PCs is emerging, leading to a gradual increase in shipments in the second half of the year. For servers, continued purchases of high-end AI training servers and the deployment of small and medium-sized generative AI models are beneficial for the development of AI inference servers. Furthermore, cloud service providers' increased capital expenditures for building AI computing power contribute to the flourishing growth of the AI server industry in 2024.

Market Intelligence & Consulting Institute (MIC) hosts the MIC Forum at Shangri-La's Far Eastern Plaza Hotel, Taipei (Taiwan) from April 16-18. For further information, please visit the Event website (available in Mandarin only).

About Market Intelligence & Consulting Institute (MIC):

Established in 1987, Market Intelligence & Consulting Institute (MIC) is a division of III (Institute for Information Industry), a major government think tank, and one of the leading IT research institutes in Taiwan. MIC specializes in industry and market research. With over three decades of experience, MIC provides valuable insights and data-driven recommendations to assist businesses in making informed decisions.

To know more about this topic, please visit: Global Notebook PC Market Forecast, 2024 - 2028, Global Desktop PC Market Forecast, 2024 - 2028, The Taiwan Server System Industry, 1Q 2024

For future receipt of press releases, please subscribe here

To know more about MIC research findings, please access our website.

For future inquiry, please contact MIC Public Relations

If you prefer not to receive notifications, please click here to unsubscribe