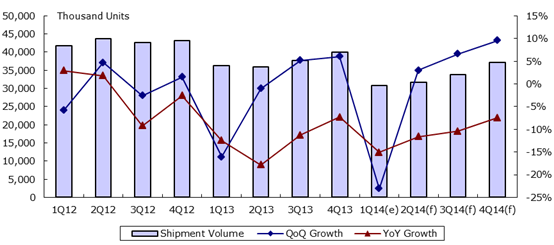

According to MIC (Market Intelligence and Consulting Institute), an ICT industry research institute based in Taipei, shipment volume of the Greater Chinese notebook PC industry topped about 40 million units in the fourth quarter of 2013, up merely 0.6% sequentially and down 7.3% year-on-year. The result also marked the second consecutive quarter of sequential shipment growth while the rate of year-on-year shipment volume decline rate also slowed down. In 2013, the industry's full-year shipment volume totaled 150 million units. Although the industry still saw 12.4% year-on-year decline, its global share still reached 86.9%. The industry's shipment performance was better than expected in the fourth quarter of 2013.

One of major factors affecting the industry's shipment in the fourth quarter is the weak market demand for notebook PCs in the first half of 2013 that cooled down PC makers' outlook for the second half of 2013. Notebook PC brands, such as HP, ASUS, and Acer, which concentrate on consumer notebook PCs however made an exception. They launched the price-reduction campaign to boost the market demand in the fourth quarter so as to seize a larger market share and retain economies of scale and they succeeded. On the other hand, the replacement demand for commercial models has begun to surface in the second half of 2013 as Microsoft plans to terminate the support of Window XP OS (Operating System) for commercial notebook PCs, beginning in April 2014. For brands whose commercial notebook PC orders accounted for the vast majority of total orders, for example, Dell, their shipment volume grew by nearly 20% in the fourth quarter of 2013. As a result, the reduced decline rate in shipment volume of consumer models coupled with the increasing replacement demand for commercial notebook PCs buoyed the shipment volume growth of Taiwan's industry in the fourth quarter.

Outlook for 1Q 2014

Due to the upcoming Chinese Lunar New Year holiday in January, some branded vendors have begun replenishing inventories at the distribution end in order to tap the market demand from promotional activities for the New Year. In addition, the advanced inventory replenishment is also to avoid the production capacity loss caused by the labor shortage, a phenomenon that normally occurs after the Chinese New Year. Fuelled by the replenishment demand in January, the industry's shipment volume only suffered from a mild decline in the fourth quarter of 2013. In anticipation of Intel's Bay Trail M, to hit the market in the second quarter of 2014, inventory clearance has begun in February and March, to cause a nearly 20% of shipment volume decline in the first quarter of 2014 compared to the previous quarter.

In 2014, although branded vendors have been expanding their deployment for touch-enabled notebook PCs, the market reception for touch models continues to be lukewarm. And touch-enabled notebook PCs' share is expected to be still below 15% in 2014. Although the costs associated with touch components have reduced, touch-enabled notebook PCs are still not quite appealing to consumers mainly due to the radical changes to the UI, limited added-value of touch, and the relatively high prices compared to traditional models. To further boost the market penetration, other than to reduce costs associated with touch modules, having a platform that provides support for modifications and user-friendly UI may be another way to go.

Greater China Notebook PC Shipment Volume, 1Q 2012 - 4Q 2014

Source: MIC, March 2014

To see more about this report, please visit: The Greater China Notebook PC Industry, 1Q 2014.

For future receipt of press releases, or more information about MIC research findings, please contact MIC Public Relations.

About MIC

Market Intelligence & Consulting Institute (MIC), based in Taipei, Taiwan, was founded in 1987. MIC is Taiwan's premier IT industry research and consulting firm providing intelligence, in-depth analysis, and strategic consulting services on global IT product and technology trends, focusing on markets and industries in Asia-Pacific. MIC is part of the Institute for Information Industry. https://mic.iii.org.tw/english