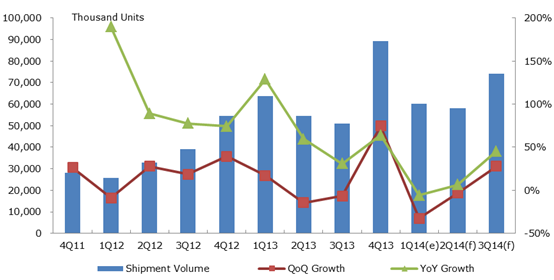

In the first quarter of 2014, traditionally a weak season for consumer electronic products, shipment volume of global tablet TFT-LCD panels reached 601.4 million units, down 32.6% sequentially. This decline is mainly ascribed to the fact that inventory clearance took place in the first quarter of 2014 following panel replenishment in the fourth quarter of 2013. In addition, some brands won't roll out their new products until the second or third quarter of 2014.

White-box Tablets Shipped to Emerging Markets Rise to Spur Chinese Makers' Market Traction

MIC Senior Industry Analyst Pei-Fen Hsieh points that compared to international tablets that are often priced higher, Chinese white-box tablets are more popularly sold in emerging markets. To cope with production costs, those low-cost white-box tablets are mainly 7-inch WVGA (Wide Video Graphics Array) models with nearly 16% of them supplied by Chinese panel makers. Being the major panel suppliers of several international branded tablets, the consolidated shipments of Korean panel makers still take up over 40% of the global tablet LCD panel shipments. In the industry, perhaps the most important part of all, though, is the launch of Android-based Xiaomi Mi Pad tablet that boasts to have specs similar to the Apple iPad mini at a lower price. Although currently available only in China, the Xiaomi Mi Pad with a higher price-performance ratio is expected to reshuffle the tablet market share as it is more than capable of competing head-to-head with Apple in the Asian market, especially in China, where Apple has pledged its focus, and with other white-box tablets in the same price range as well.

Replacement Demand Key for Growth; Tablet Spec War Seems to Ease

Tablets, though not a must-have, have created the market scale similar to notebook PCs, targeting mainly the first-time buyers. Future market potentials of tablets are therefore deemed promising. However, product positioning and segmentation of tablets are quite diverse as users may use a tablet for entertainment, business or education purposes and will affect how brands set product specs and prices of their tablets for the sake of market share. In other words, the role shift of tablets will affect brands' panel size decisions, for instance, the introduction of 12" tablets is to meet users' demand for a notebook PC in some use cases. If market volume of tablets eventually hits the ceiling, the replacement demand will become key growth driver. Given no much room for improvement when it comes to tablet hardware specs, prices will play a key factor and what to trigger the replacement demand will be crucial in determining the future development of tablets.

Worldwide Tablet TFT-LCD Panel Shipment Volume, 4Q 2011 - 3Q 2014

Source: MIC, June 2014

For future receipt of press releases, or more information about MIC research findings, please contact MIC Public Relations.

About MIC

Market Intelligence & Consulting Institute (MIC), based in Taipei, Taiwan, was founded in 1987. MIC is Taiwan's premier IT industry research and consulting firm providing intelligence, in-depth analysis, and strategic consulting services on global IT product and technology trends, focusing on markets and industries in Asia-Pacific. MIC is part of the Institute for Information Industry. https://mic.iii.org.tw/english