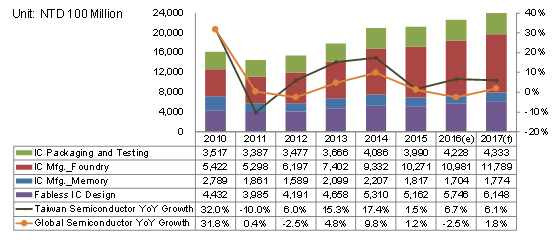

The semiconductor industry is anticipated to continue to occupy a dominant position in Taiwan's IT industry in 2017, with a shipment value of NT$2.4 trillion (USD75.7 billion; USD 1 = NT$31.7) and a year-on-year growth of 6.1%, higher than the global average, according to MIC (Market Intelligence & Consulting Institute). "This will be mainly owing to the slowdown in PC shipment decline, the resumed growth of smartphones, and new foundry capacities," says Chris Hung at a press conference held in Taipei on September 5.

MIC is proud to announce that the 29th MIC Forum will be held on September 6-14 in Taipei (Sep 6-8, 13-14), Hsinchu (Sep 9) and Kaohsiung (Sep 9). Come and visit our event website at MIC EVENTS to know more!

Worldwide Semiconductor Shipment Value by Sub-industry, 2010-2017

Source: MIC, September 2016

"While the semiconductor growth is expected to remain unabated in 2017, the PC industry is still hoping for a long-awaited rebound as demand for consumer PCs remains weak," says Charles Chou at the same venue. Worldwide shipment volume of PC systems - comprising of notebook PCs, desktop PCs, tablets, and servers - is forecast to total 424 million units in 2017, down 4.4% year-on-year. Except server which is estimated at over 5% year-on-year growth, shipment volume of all PC systems will keep declining in 2017 albeit at a slower rate. "Also what we have found is that Taiwanese makers' notebook PC shipment volume has not been affected too significantly by Chinese counterparts and therefore Taiwanese notebook PC industry's global share will likely to manage to stay at the same level in 2017."

Hung notes that this year the fabless IC industry has been doing relatively well compared to other semiconductor sub-industries and is anticipated to grow by 11.3% compared to 2015 with a shipment value of NT$574.6 billion (USD18.13 billion). "There are many growth contributors, including the strong sales of their Chinese smartphone clients, the integration of Taiwanese controller ICs into the supply chain of the world's tier-one companies, and the increased shipments of panel driver IC manufacturers for high-end LCD TVs," says Hung. Looking ahead to 2017, shipment value of the Taiwan fabless IC industry is forecast to grow by 7% to NT$614.8 billion (USD19.4 billion).

The foundry industry is another growth driver of Taiwan's semiconductor industry and its shipment value is anticipated to reach NT$1.09 trillion (USD34.4 billion) and NT$1.18 trillion (USD37.2 billion) in 2016 and 2017, respectively. Year-on-year growth rates are estimated at 6.9% and 7.4%.

To see more about this report, please visit: Global DRAM Supply and Demand Forecast, 1H 2016; Taiwanese Semiconductor Manufacturing Industry, 2Q 2016; Recap and Outlook for the Worldwide IC Foundry Industry in 2016; Worldwide Tablet Forecast, 2016-2020; Worldwide Desktop PC Forecast, 2016-2020; Worldwide Notebook PC Forecast, 2015-2020; Worldwide Motherboard Market Forecast, 2015-2019

For future receipt of press releases, or more information about MIC research findings, please contact MIC Public Relations.

About MIC

Market Intelligence & Consulting Institute (MIC), founded in 1987 and based in Taipei, is the Taiwan's premier IT industry research and consulting firm focused on IT product and technology trends in the world, particularly the Asia Pacific region. MIC provides intelligence, in-depth analysis, and strategic consulting services and is part of the Institute for Information Industry. https://mic.iii.org.tw/english

* For any ambiguity between English and Chinese version, the Chinese version shall prevail.